Received cash for the maturity value of NR2: principal, $247.50, plus interest $4.07 total $251.57. Received cash from Robert Shull for 200 shares of $ 10.00 stated-value common stock at $ 10.00 per share, $2,000.00. Paid cash for the maturity value of NP4: principal, $300.00, plus interest, $6.00 total, $306.00.

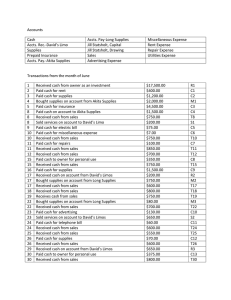

Paid cash to Marlin Pratt for 60 shares of $ 10.00 stated-value common stock at $9.00 per share, $540.00. Received cash from sale of office euipment, $70.00: original cost, $700.00 total accumulated depreciation through December 31 of last year, $500.00 additional depreciation to be recorded through December 11 of the current year, $ 100.00. Received cash for the maturity value of NR1, principal, $ 150.00, plus interest, $2.47 total, $ 152.47. Received cash from Leslie Johns for 700 shares of $ 10.00 state-value common stock at $ 11.00 per share, $7,700.00. Paid cash to bond trustee for annual deposit to bond sinking fund, $ 18,400.00, and recoded interest earned on bond sinking fund, $ 1,600.00. Paid cash to bond trustee for annual interest on bond issue, $24,000.00. Received a 60-day, 10% note from Leigh Calhoun for an extension of time on her account, $500.00. M320.ĭiscarded an office table: original cost, $250.00 total accumulated depreciation through December 31 of last year, $ 150.00 additional depreciation to be recorded through December 4 of the current year, $50.00. Patrick Carson dishonored NR4, a 30-day, 10% note, maturity value due today: principal, $ 150.00 interest, $ 1.25 total, $151.25. Paid cash for office equipment, $2,650.00. Paid-in Capital from Sale of Treasury Stock Paid-in Capital in Excess of Stated Value. Received a subscription from Delmar Adams for 30 shares of $ 100.00 par-value preferred stock, $3,000.00. R126.ĭiscarded a store fixture: original cost, $ 1,050.00 total accumulated depreciation through December 31 of last year, $840.00 additional depreciation to be recorded through December 1 of the current year, $210.00. Received cash for three months' rent in advance from Woodcrest, Inc., $2,400.00. Wrote off Susan Vine's past-due account as uncollectible, $427.50. Common stock issued is $ 11,780.00 of $ 10.00 stated-value common stock. Preferred stock issued is $40,400.00 of 10%, $ 100.00 par-value preferred stock. Whitehurst's board of directors declared an annual dividend of $ 15,820.00. Source documents are abbreviated as follows: check, C memorandum, M note payable, NP note receivable, NR receipt, R. Other prepaid and unearned items are recorded initially as assets and liabilities. Whitehurst records prepaid interest expense initially as an expense and rent received in advance as revenue. Use page 23 of a cash receipts journal, page 23 of a cash payments journal, and page 12 of a general journal. Journalize the following transactions completed during December of the current year.The journals used by Whitehurst are similar to those illustrated in Parts 2 through 4.

Whitehurst uses the chart of accounts shown on page 403. In Part A of this reinforcement activity, selected transactions for Whitehurst, Inc., completed during December of the current year, are journalized. Whitehurst's fiscal year is from January 1 through December 31. Whitehurst sells plumbing and related products to building contractors, homeowners, and other Consumers. The accounting activities are for Whitehurst, Inc., a merchandising business organized as a Corporation.

0 kommentar(er)

0 kommentar(er)